Price Modeling

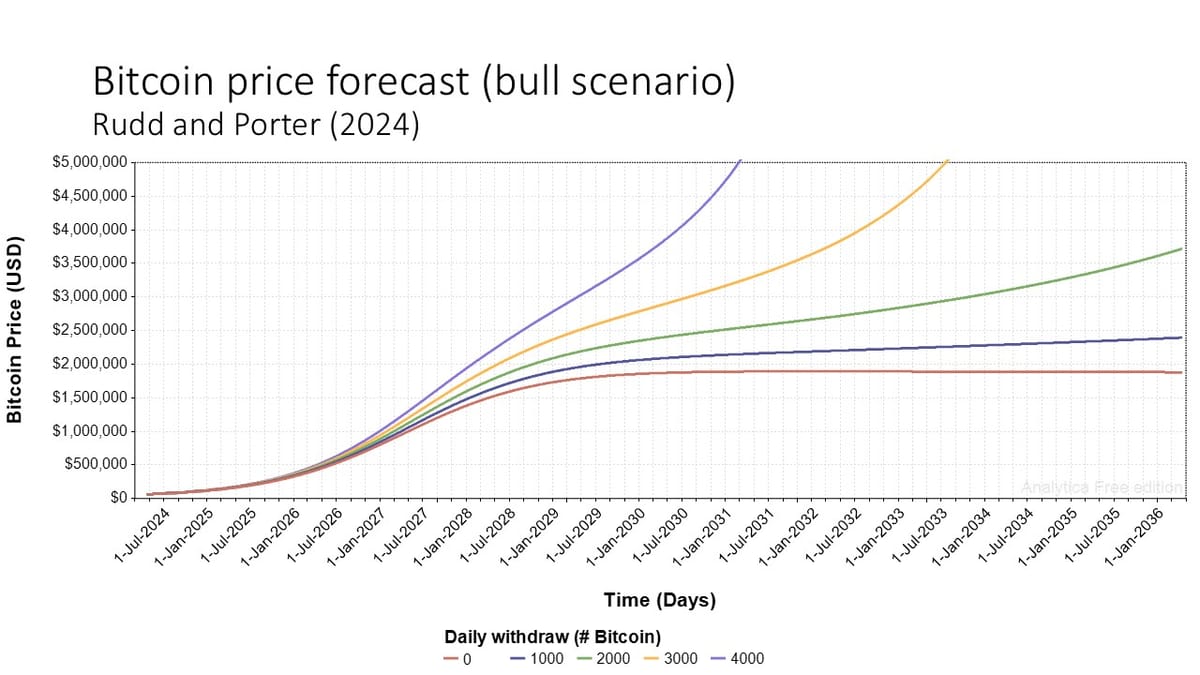

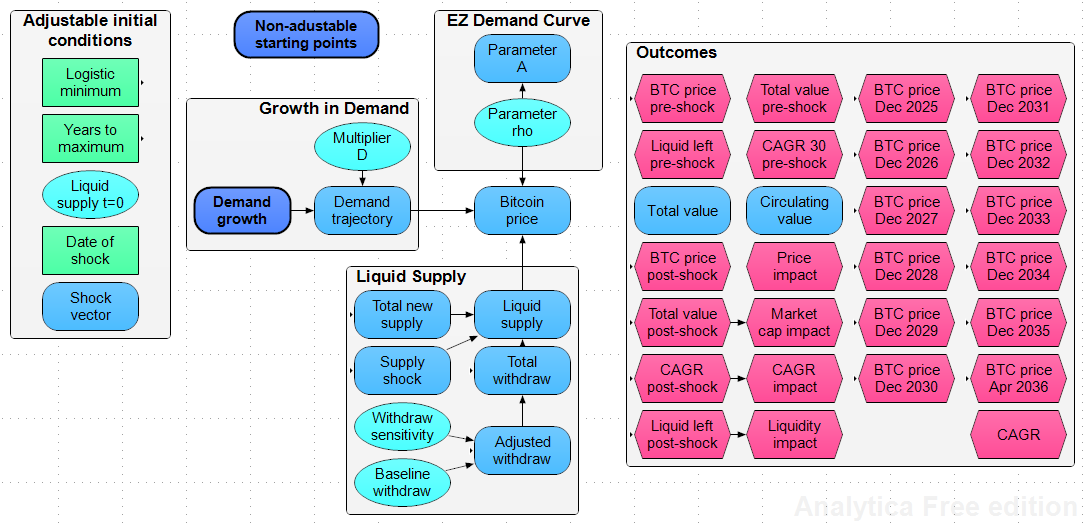

A non-technical background on our Bitcoin price forecast framework and examples of how it can be applied to develop specific models that probe the impacts of specific supply and demand shocks.

The most recent technical paper on the framework is available at: https://dx.doi.org/10.2139/ssrn.5386623

Example of a Bitcoin price model

Introduction to our Bitcoin price modeling framework for non-technical readers, with example of the impact of a single 500,000 Bitcoin purchase

Understanding Bitcoin Supply & Demand - A Backgrounder

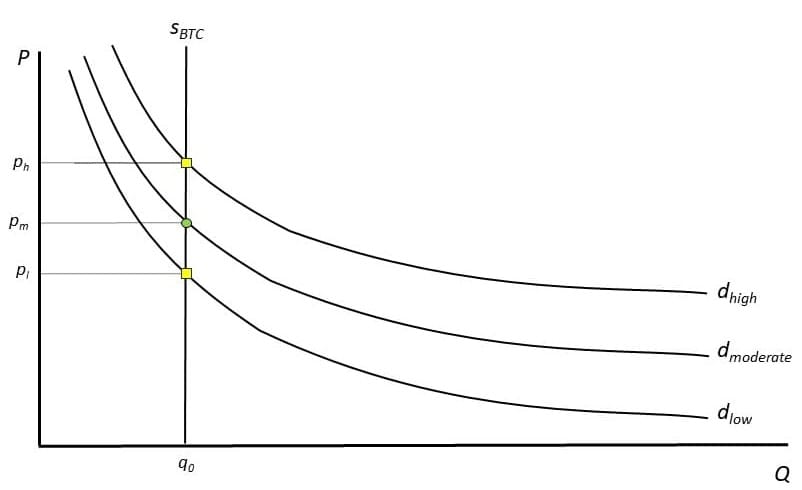

Our Bitcoin price forecast framework is based on aggregate market supply and demand ‘working together’ to figure out equilibrium prices.

Bitcoin supply, demand, and price dynamics

We develop a bottom-up, quantity-clearing model of Bitcoin price formation that couples its fixed 21-million-coin cap with plausible demand growth and execution behavior.

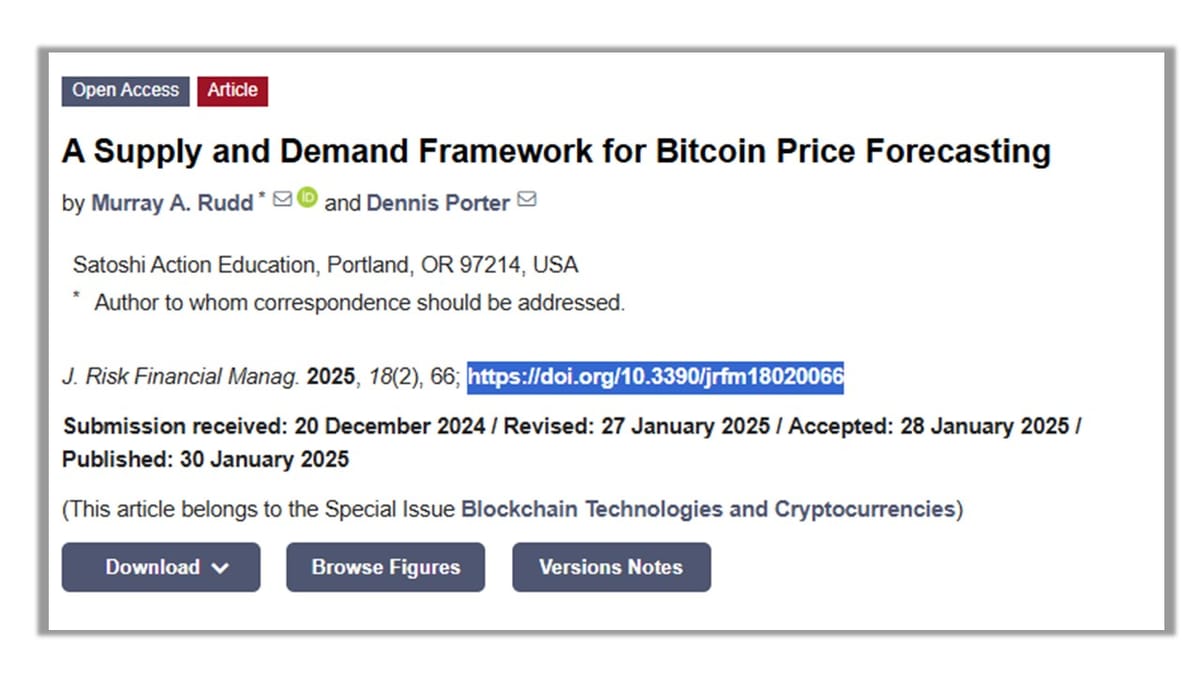

Update - Bitcoin pricing framework / model published!

I’m happy to announce that our new journal article, “A supply and demand framework for Bitcoin price forecasting,” was published today and is now available for free download from the Journal of Risk and Financial Management. Click on the link below: A Supply and Demand Framework for Bitcoin Price ForecastingWe

Forecasting Bitcoin Prices Using Supply & Demand Dynamics

This post gives a non-technical summary of our new Satoshi Action working paper. We developed a Bitcoin supply-and-demand framework and model for forecasting Bitcoin price trajectories out to 2036.