Bitcoin Research Priorities in 2025: Beyond First-Order Effects

This paper presents a 2025 horizon scan that adapts the logic of key questions exercises to Bitcoin-centric long-form podcast and interview discourse, drawing on 2,297 episodes to infer policy-salient research priorities.

Background

Over the past decade, Bitcoin has generated an enormous amount of debate about price, adoption, energy use, regulation, and whether it “works” at all.

But one thing has changed decisively in the last few years: the question is no longer whether Bitcoin matters. The question is how it interacts with the systems it is increasingly embedded in, and where our understanding is still dangerously incomplete.

Below is the full text for my new working paper, “Bitcoin Research Priorities in 2025: Beyond First-Order Effects.”

This work identifies 100 policy-salient research questions distilled from thousands of hours of long-form Bitcoin discussions - questions that, if answered, would materially improve decision-making by policymakers, researchers, investors, and institutions.

For anyone looking at this website, you will see a small portion of the 'briefing notes' I ran for each of the 2,000+ podcast episodes I summarized in 2025. These - and the others I did not post publicly - comprise the dataset I used in the analysis.

I want to be clear from the start: this is not a price forecast, it’s not an advocacy piece, and it’s not a claim that Bitcoin “fixes” anything by default. It’s a diagnostic map of where informed participants believe the real knowledge gaps now lie.

The full paper follows below. It's a dense read: a pdf version is also available for those who prefer to print out a paper copy (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=6032217).

Abstract

Rapidly evolving technologies often generate policy-relevant risks and opportunities faster than conventional research cycles can accommodate. Bitcoin exemplifies this challenge, as practitioner discourse increasingly emphasizes institutional fragility, governance under stress, infrastructure constraints, and indirect system effects that remain weakly covered in the academic literature. This paper presents a 2025 horizon scan that adapts the logic of key questions exercises to Bitcoin-centric long-form podcast and interview discourse, drawing on 2,297 episodes to infer policy-salient research priorities. Using consistent selection criteria emphasizing technological significance, societal and economic impact, policy relevance, interdisciplinary potential, urgency, and generalizability, the scan identifies 100 priority research questions organized across eight thematic domains spanning macroeconomic stability, geopolitics, market structure, mining and energy systems, protocol risk, custody and intermediation, regulation, and social behavior. Compared to earlier scans, the 2025 results reflect a shift away from first-order debates about adoption and legitimacy toward higher-order research questions about implementation, fragility, and feedback effects as Bitcoin becomes embedded in existing economic and institutional systems.

Introduction

Emerging technologies increasingly shape economic stability, political power, and social organization in ways that outpace conventional research and policy cycles. When technologies evolve rapidly and interact with existing institutions, early signals of risk and opportunity often appear first outside formal academic channels, embedded in practitioner discourse, market behavior, and policy experimentation. Traditional research pipelines, while essential for validation, tend to respond slowly to these signals, creating a persistent lag between real-world developments and the evidence base available to decision-makers (Jasanoff, 2004; Kattel and Mazzucato, 2018).

Bitcoin exemplifies this challenge. More than 17 years after its introduction (Nakamoto, 2008), it continues to sit uneasily across disciplinary boundaries, simultaneously raising questions that bridge monetary policy, financial stability, energy systems, cybersecurity, governance, and social behavior. Academic research on Bitcoin has expanded substantially, yet much of it remains concentrated in narrow domains such as price dynamics, market efficiency, or energy consumption. At the same time, practitioners increasingly debate higher-order impacts – custody fragility, institutional leverage, regulatory durability, infrastructure competition, and geopolitics – that do not fit neatly into established research categories.

This disconnect matters because many of Bitcoin’s most consequential impacts are unlikely to arise from its basic technical design alone. Instead, they emerge from interactions between Bitcoin, legacy institutions, and politics: banking systems under stress; regulatory frameworks designed for intermediated finance; electricity grids adapting to new forms of flexible demand; and political systems grappling with capital mobility and enforcement limits. Understanding these interactions requires identifying not only what is known but, where knowledge remains incomplete, contested or poorly aligned, with emerging decision needs. That implies the need for transdisciplinary research (Pennington et al., 2013; Thompson Klein, 2008) that bridges gaps between Bitcoin researchers, practitioners, and policy-makers (Rudd, 2023d).

Horizon scanning and key questions exercises offer a structured way to address this gap by systematically identifying important research needs before they are widely recognized in the literature (Sutherland et al., 2011). Traditionally, such exercises rely on community-wide solicitation of information gaps and research needs, and workshop-based expert deliberation to identify and prioritize candidate questions. While effective, these approaches are resource-intensive and difficult to scale in domains where relevant expertise is widely distributed across industry, investment, technical, and policy communities rather than concentrated in academia, where real-world technical information and developments may not be well understood.

This paper presents the results of a 2025 horizon scan that adapts the logic of key questions exercises to Bitcoin-centric public discourse. By inferring research priorities from >2,000 hours of long-form podcast and interview content, the scan identifies 100 policy-salient research questions organized across eight thematic domains. Rather than offering predictions or normative prescriptions, my goal is to map perceived information gaps at a moment when Bitcoin’s integration into economic and institutional systems is deepening. In doing so, the 2025 scan provides a structured starting point for researchers, policy-makers, and practitioners seeking to engage with Bitcoin’s evolving risks, constraints, and opportunities.

Methodology

Key questions exercises are widely used to identify policy-salient research needs in fields characterized by complexity, uncertainty, and rapid change (Boxall et al., 2012; Fleishman et al., 2011; Oldekop et al., 2016; Pretty et al., 2010; Rudd et al., 2018; Sutherland et al., 2009; Sutherland et al., 2013). Traditional exercises typically solicit candidate research questions from academics, policy-makers, and practitioners, screen them for relevance and redundancy, organize them thematically, and then refine the pool through expert deliberation to produce a final list of priority questions (Sutherland et al., 2011). While this approach remains valuable, it is resource-intensive and slow relative to the pace at which Bitcoin’s technological, economic, and political context continues to evolve (Rudd, 2023c, d).

As in earlier scans (Rudd, 2024, 2023a, 2025a, c), I adapted the key questions framework to draw on long-form public discourse as a proxy for distributed expert knowledge. Rather than soliciting questions directly, I inferred research needs from potential threats and opportunities raised during sustained conversations among industry practitioners, investors, technologists, and policy-adjacent commentators: emerging issues are often articulated in these discussions long before they appear in academic or policy literatures. This approach preserves the core logic of a key questions exercise – identifying important, unanswered questions – while allowing the process to rapidly scale to thousands of hours of discussion.

Podcast episode selection

I followed the same selection principles used in prior scans, focusing on Bitcoin-relevant YouTube and podcast episodes that provide extended, substantive discussion. For the 2025 scan, episode identification and transcription were largely automated, drawing on curated subscription lists, RSS feeds, and platform searches, yielding a total of 2,297 individual episodes. Episodes were retained if they met three criteria: a minimum duration of approximately 30 minutes; a primary focus on Bitcoin (rather than alternative digital assets) or, rarely, a focus on technological advances with important implications for Bitcoin; and content structured around interviews or extended analytical discussion rather than short-form news updates.

With an average episode length of roughly one hour, the resulting corpus represents more than 2,000 hours of conversation. While these discussions are not equivalent to formal semi-structured interviews (Harrell and Bradley, 2009), their scale and depth far exceed what is feasible in conventional qualitative research projects and capture a wide range of technical, economic, social, and policy-relevant perspectives within the Bitcoin ecosystem.

Identification of issues and candidate research questions

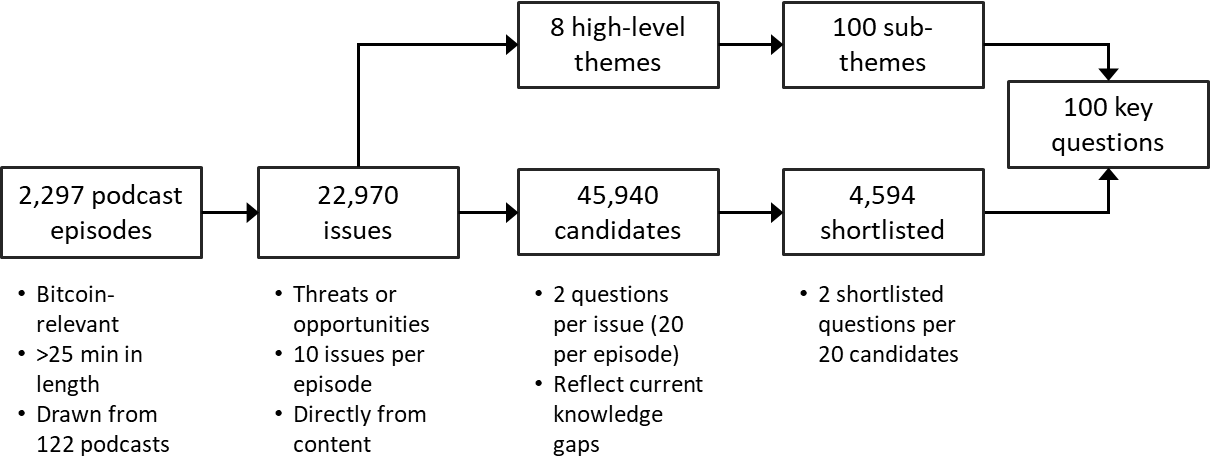

For each episode, a structured analytical pipeline was used to extract emerging issues and translate them into candidate research questions. At the episode level, salient topics were framed as threats or opportunities, each accompanied by a brief rationale. These “issues” served as the basis for generating candidate research questions that reflected gaps in current knowledge rather than advocacy positions (Figure 1). GPT5.2 Pro was used to assist in theme clustering and the identification and candidate questions.

From the set of 20 episode-level candidate questions, a short list of five priority questions was retained for each episode. Selection followed consistent criteria: technological significance and risk mitigation; societal and economic impact; policy and political relevance; interdisciplinary potential; urgency and feasibility; and generalizability beyond Bitcoin to analogous systems. This step produced a bounded dataset of five prioritized questions per episode.

Theme and subtheme development

The synthesis phase proceeded top-down rather than through unsupervised clustering. Drawing on experience from prior horizon scans, I defined eight broad themes intended to ensure comprehensive coverage of Bitcoin’s macroeconomic, geopolitical, institutional, technical, regulatory, and social dimensions. Within these themes, I identified 100 subthemes that capture recurring topics evident across the episode-level issues and questions.

Subthemes function as analytical categories rather than emergent clusters. Each represents a distinct topic that recurred frequently enough, or carried sufficient potential impact, to warrant its own research question.

Selection of final key questions

For each subtheme, a single research question was selected from the total pool of shortlisted key questions, ensuring that all final questions were directly traceable to the underlying discourse. Where similar questions appeared across multiple episodes, the version that best satisfied the selection criteria – particularly policy relevance, generalizability, and clarity – was retained.

The resulting set comprises 100 unique research questions, one per subtheme, distributed across eight themes. Light editorial refinement was applied to improve clarity and standalone readability, consistent with standard practice in key questions exercises.

Interpretation and limitations

The final list of questions represents inferred information gaps. They reflect convergent views expressed across practitioner discourse rather than conclusions supported by existing empirical literature. The output should therefore be understood as a structured starting point for prioritizing future research rather than a definitive research agenda.

Results

Macroeconomics, Monetary Systems, and Financial Stability

High sovereign debt, persistent inflation pressures, and repeated liquidity shocks continue to strain the credibility of monetary institutions and the resilience of household and corporate balance sheets (Adrian and Shin, 2010; Aizenman and Marion, 2011; Brandao-Marques et al., 2024). In this environment, Bitcoin’s fixed supply and global liquidity may offer an alternative store-of-value benchmark (Bouri et al., 2017; Chan et al., 2019) that can influence hedging behavior, reserve debates, and expectations about monetary stability, even when most economic activity remains denominated in fiat currencies. The Theme 1 questions translate these conditions into testable propositions, focusing on transitions between inflationary and deflationary dynamics (Braumann, 2004; Glawe and Wagner, 2024; Heymann and Leijonhufvud, 1995), the constraints fiscal dominance imposes on central bank independence (Brandao-Marques et al., 2024), the extent to which liquidity cycles transmit into Bitcoin demand and price (Chen et al., 2025), and the market-structure mechanisms that can amplify volatility through liquidity gaps and liquidation cascades (Adrian and Shin, 2010). Stablecoins enter the theme as a macro-relevant innovation because rapid growth can reshape dollar liquidity, Treasury demand, and monetary transmission, with knock-on effects for financial stability (Kim, 2025; Li and and Shen, 2021; Yadav and Malone, 2025).

Table 1. 14 key research questions regarding macroeconomics, monetary systems, and financial stability.

|

Subtheme |

Question |

|

|

01 |

Inflation vs.

deflation endgames under high sovereign debt |

Under what debt

and demographic conditions do advanced economies shift from inflationary to

deflationary dynamics, and how should households adjust hedging strategies

across regimes? |

|

02 |

Monetary

dominance vs. fiscal dominance and regime shifts |

What monetary

policy tools remain effective when fiscal dominance limits central bank

independence and inflation persists? |

|

03 |

Liquidity cycles

and demand sensitivity |

How reliable is

the correlation between global liquidity measures and Bitcoin price movements

for forecasting demand over 3–12 months? |

|

04 |

Real yields and

opportunity cost |

How do changes in

real yields and term premia alter the opportunity cost of holding Bitcoin

relative to long-duration assets? |

|

05 |

Bitcoin as hedge

across shocks |

Under which macro

shock types and horizons does Bitcoin behave as a hedge rather than a risk-on

asset? |

|

06 |

Systemic risk

from leveraged exposure |

How can financial

institutions scale Bitcoin-backed lending without introducing hidden leverage

and systemic fragility? |

|

07 |

Reserve asset

competition |

How would

large-scale government adoption of Bitcoin alter reserve composition and

global monetary bargaining power? |

|

08 |

Banking stress

and deposit flight |

How does

banking-sector stress influence household and corporate shifts into Bitcoin

during deposit flight and confidence shocks? |

|

09 |

Cross-asset

correlations in crises |

How do Bitcoin

correlations with equities, bonds, and commodities change during acute crises

versus slow-moving macro stress? |

|

10 |

Measurement gaps

in inflation |

How can policy-makers

measure real purchasing-power erosion when housing and essential costs

diverge from headline CPI? |

|

11 |

Discount rates

and long-term planning |

Does widespread

Bitcoin adoption measurably reduce discount rates, and how would that change

long-horizon investment decisions? |

|

12 |

Stablecoins and

dollar liquidity |

How does rapid

stablecoin growth affect dollar liquidity, Treasury demand, and monetary

transmission? |

|

13 |

Market

microstructure fragility |

What

market-structure mechanisms drive liquidity gaps and liquidation cascades in

Bitcoin markets during macro shocks? |

|

14 |

Transition and

monetization risks |

How can models

distinguish gradual Bitcoin monetization from abrupt regime shifts that

threaten financial stability? |

Answering these questions would improve macroeconomic diagnosis by clarifying which regimes drive Bitcoin’s hedging behavior, which indicators provide early warning of shifts between inflation and deflation, and which policy tools remain effective when fiscal dominance limits conventional options. More credible measurement of purchasing-power erosion – especially where housing and essentials diverge from headline CPI – would strengthen the evidentiary basis for monetary and fiscal decisions and reduce disputes driven by metric selection. At the market level, identifying the mechanisms behind liquidity gaps and liquidation cascades would strengthen institutional risk management for Bitcoin-linked products and inform guardrails that reduce fragile feedback loops during stress.

Indirectly, research programs focused on these questions would clarify how confidence shocks propagate into portfolio behavior, including the conditions under which banking stress triggers household and corporate shifts into Bitcoin and the channels through which stablecoin growth interacts with dollar funding markets. Evidence on these channels would sharpen debates about reserve-asset competition and the durability of monetary transmission as alternative rails and alternative stores of value become more widely used. Taken together, the results would help policy-makers distinguish between Bitcoin as a crisis hedge, Bitcoin as a volatility amplifier, and Bitcoin as a structural constraint on policy space in high-debt economies, providing a clearer basis for stress testing, communications, and institutional design.

Nation-States, Geopolitics, and Sovereignty

Nation-states increasingly treat Bitcoin as both a financial technology and a strategic variable that intersects with sanctions, capital controls, reserve management, and energy policy (Alexakis et al., 2024; Keere and Novokreshchenov, 2025; Smith, 2019). The Theme 2 questions focus on how states and citizens adapt when an uncensorable asset becomes widely accessible, including whether and how governments should hold Bitcoin as a reserve, how Bitcoin changes the effectiveness of sanctions and cross-border enforcement, and how it alters incentives for regulatory and tax competition across jurisdictions (Ferranti, 2024; Ju et al., 2016; Zilioli et al., 2024). The theme also emphasizes real-world constraints: state capacity, corruption risk in state-linked mining, and the political economy of monetizing stranded energy resources. Taken together, these questions frame Bitcoin as a factor that can reshape sovereignty at two levels: top-down through state strategy; and bottom-up through citizens’ ability to exit fragile monetary regimes.

Table 2. 12 imporant research questions regarding nation-states, geopolitics, and sovereignty.

|

No. |

Subtheme |

Question |

|

15 |

Strategic Bitcoin reserves |

What reserve-allocation frameworks can guide governments

on whether, when, and how much Bitcoin to hold while limiting stability

risks? |

|

16 |

Sanctions and financial bypass |

To what extent does Bitcoin reduce sanctions

effectiveness, and under what conditions does state use increase escalation

risk? |

|

17 |

Capital controls and exit risk |

How does Bitcoin adoption change household and firm

behavior under tightening capital controls and cross-border restrictions? |

|

18 |

Regulatory arbitrage |

Which regulatory and tax features most strongly drive

relocation of Bitcoin firms, capital, and talent across jurisdictions? |

|

19 |

First-mover geopolitical advantage |

Does early state-level Bitcoin accumulation confer durable

strategic advantage, or mainly increase volatility and political risk? |

|

20 |

Energy geopolitics |

How does state-linked Bitcoin mining alter the

geopolitical value of stranded or underutilized energy resources? |

|

21 |

Conflict and displacement |

How effectively can Bitcoin function as a portable store

of value during war, state collapse, or mass displacement? |

|

22 |

Currency attacks and credibility |

How does widespread Bitcoin availability change the

probability and speed of confidence-driven currency runs? |

|

23 |

Enforcement limits |

What practical limits do decentralized Bitcoin networks

impose on cross-border financial enforcement and compliance? |

|

24 |

State capacity and corruption risk |

What governance and transparency mechanisms prevent

corruption and rent-seeking in state-affiliated Bitcoin mining initiatives? |

|

25 |

Trade and settlement |

Under what conditions could Bitcoin-denominated trade or

commodity contracts reduce settlement risk without increasing counterparty

volatility? |

|

26 |

International coordination |

Is partial international coordination on Bitcoin

regulation feasible without undermining sovereignty, and which domains most

need harmonization? |

Addressing these questions would give policy-makers practical evidence supporting reserve design and risk management, including clearer frameworks for sizing, timing, and governing strategic Bitcoin allocations without destabilizing domestic monetary systems. Evidence on sanctions circumvention and escalation risk would help governments evaluate where Bitcoin materially weakens coercive financial tools and where alternative policy instruments or international coordination become necessary. Research on confidence-driven currency runs and capital controls would improve crisis planning by clarifying when Bitcoin availability increases the probability or speed of capital flight, and what early warning indicators can guide response. Better understanding of cross-border enforcement limits and the determinants of jurisdictional relocation would also inform regulatory strategy, reducing unintended consequences such as driving talent and capital offshore without achieving policy objectives.

Indirectly, this theme speaks to how monetary sovereignty evolves when citizens and firms can hold an asset that is portable, liquid, and difficult to block at the network level, especially in conflict, disaster, or displacement scenarios (Alexakis et al., 2024). Findings on state-linked mining and stranded-energy monetization (Dasaklis et al., 2025; Rudd et al., 2024) would connect geopolitics to infrastructure, clarifying when mining becomes a strategic outlet for energy resources and when it becomes a governance liability. Research on partial international coordination would also illuminate where harmonization is feasible without eroding sovereignty, and which domains – custody, disclosure, enforcement, or taxation – benefit most from shared standards. Collectively, the results would clarify whether Bitcoin primarily increases geopolitical competition, strengthens citizen resilience under repression and instability, or forces a redesign of the tools states use to project financial power.

Corporate, Institutional, and Market Structure

Corporate and institutional engagement with Bitcoin has moved beyond speculative exposure into balance-sheet strategy, market infrastructure, and financial intermediation (Akhtaruzzaman et al., 2020; Ang et al., 2022; Botta et al., 2025; Phillips and Pohl, 2024). The Theme 3 questions examine how Bitcoin is integrated into corporate treasuries, investment vehicles, custody arrangements, derivatives markets, and credit structures (Augustin et al., 2023; Botta et al., 2025; Mazur and Polyzos, 2025; Mohamad, 2025), with particular attention to governance, transparency, and systemic risk. Rather than treating institutions as passive adopters, the theme focuses on how accounting rules, financing structures, margining practices, and market concentration shape incentives and feedback loops that can amplify or dampen volatility. By centering on market plumbing – ETFs, custodians, prime brokers, settlement systems, and proof-of-reserve standards – the questions frame institutional Bitcoin adoption as a structural shift in financial architecture rather than a marginal asset-allocation decision.

Table 3. 14 imporant research questions regarding corporate, institutional, and market structure.

|

No. |

Subtheme |

Question |

|

27 |

Corporate treasury governance |

What governance and risk-limit frameworks enable corporate

Bitcoin allocations while maintaining fiduciary accountability? |

|

28 |

Accounting and disclosure |

How does fair-value accounting for Bitcoin change

risk-taking incentives and financial statement comparability across firms? |

|

29 |

ETF integrity |

How can spot Bitcoin ETFs ensure continuous full backing

and prevent rehypothecation during market stress? |

|

30 |

Hidden leverage |

Where does hidden leverage arise in Bitcoin-linked

products, and which indicators detect it early enough to reduce systemic

risk? |

|

31 |

Structured financing |

Are Bitcoin-related convertible and hybrid financing

structures robust across rate regimes, or do they amplify downside via forced

selling? |

|

32 |

Equity valuation |

How can investors distinguish justified strategic premiums

from reflexive overvaluation in Bitcoin-heavy corporate equities? |

|

33 |

Margin and collateral |

What margining and collateral standards prevent

forced-liquidation cascades tied to institutional Bitcoin exposure? |

|

34 |

Derivatives stress transmission |

How do funding rates, basis trades, and liquidation

mechanisms transmit stress across Bitcoin spot and derivatives markets? |

|

35 |

Settlement and clearing risk |

What settlement and clearing failures pose the greatest

systemic risk as Bitcoin integrates with traditional market infrastructure? |

|

36 |

Institutional stress testing |

Which stress-testing and scenario frameworks best capture

tail risks unique to institutional Bitcoin adoption? |

|

37 |

Corporate custody choices |

How should corporations balance self-custody benefits

against operational, regulatory, and reputational constraints? |

|

38 |

Corporate demand shocks |

Does large-scale corporate Bitcoin adoption dampen

long-term volatility, or intensify boom–bust dynamics through balance-sheet

reflexivity? |

|

39 |

Market concentration |

Which concentration points in Bitcoin trading venues,

custodians, or liquidity providers create the highest systemic risk? |

|

40 |

Auditability |

What audit and proof-of-reserve standards restore trust in

large Bitcoin intermediaries without undermining user sovereignty? |

Answering these questions would strengthen institutional risk management by clarifying which governance frameworks allow corporate Bitcoin allocations without undermining fiduciary accountability or encouraging reflexive leverage. Evidence on accounting treatment, structured financing, and hidden leverage would improve comparability across firms and help regulators and investors identify where balance-sheet risk accumulates before it becomes systemic. Insights into derivatives mechanics, margin standards, and liquidation dynamics would inform market-structure choices that reduce cascading failures during stress, while clearer standards for custody, auditability, and proof-of-reserves would address persistent trust deficits exposed by prior institutional failures. Together, these findings would support more robust design of Bitcoin-linked financial products and reduce the likelihood that institutional adoption recreates familiar fragilities from traditional finance.

These types of research projects and programs would clarify how institutional behavior reshapes Bitcoin markets themselves, including whether large corporate holdings stabilize prices over long horizons or intensify boom–bust cycles through balance-sheet reflexivity. Understanding concentration risks across venues, custodians, and liquidity providers would inform debates about decentralization at the market-infrastructure level, not just at the protocol layer. More broadly, the results would help policy-makers and market participants distinguish between healthy financial integration – where Bitcoin expands choice and resilience – and financialization paths that concentrate risk behind opaque intermediaries (Rudd, 2025b). In doing so, the theme contributes to a clearer assessment of whether institutional Bitcoin adoption strengthens overall market integrity or introduces new systemic vulnerabilities that require targeted oversight.

Bitcoin Mining, Energy, and Infrastructure

Bitcoin mining sits at the intersection of energy systems, industrial policy, and financial security because it converts electricity into network security and a globally liquid asset (Rudd, 2023c). The Theme 4 questions focus on how mining interacts with grid reliability, emissions measurement, demand response, stranded energy monetization, and the long-run security budget as block subsidies decline (Carter et al., 2023; Hajiaghapour-Moghimi et al., 2024; Hakimi et al., 2024; Köhler and Pizzol, 2019; Lal et al., 2024; Lal and You, 2024; Menati et al., 2023; Niaz et al., 2022b; Sai and Vranken, 2023; Shan and Sun, 2019). The theme treats mining not as a monolith but as a set of location-specific operating models with different externalities, including non-carbon impacts that drive local political constraints. It also reflects a converging infrastructure landscape, where data centers increasingly allocate power, capital, and site capacity across Bitcoin mining and AI and high-peformance computing (HPC) workloads (Al Kez et al., 2022; Crozier and Liska, 2025; Davenport et al., 2024; Fridgen et al., 2021; Lei and Masanet, 2022), creating a new class of competition and coordination problems for utilities, regulators, and communities.

Table 4. Six imporant research questions regarding Bitcoin mining, energy, and infrastructure.

|

No. |

Subtheme |

Question |

|

41 |

Energy mix credibility |

How reliable are claims about Bitcoin mining’s energy mix,

and what verification standards make emissions reporting policy-credible? |

|

42 |

Demand response |

Which demand-response designs allow Bitcoin miners to

support grid reliability without increasing net costs to other ratepayers? |

|

43 |

Grid impacts |

Under what grid conditions does Bitcoin mining reduce

congestion and curtailment versus increase local reliability risks? |

|

44 |

Methane mitigation |

To what extent does Bitcoin mining with flared or vented

gas reduce net methane-equivalent emissions, and which regulatory conditions

determine outcomes? |

|

45 |

Community benefits |

Which community-benefit frameworks most effectively

translate mining revenues into durable local economic gains? |

|

46 |

Non-carbon impacts |

What non-carbon environmental impacts of Bitcoin mining

are most salient locally, and how should regulators evaluate tradeoffs? |

|

47 |

Security budget |

How resilient is Bitcoin’s security budget under declining

subsidies, given plausible fee-market dynamics? |

|

48 |

Hashrate geography |

How does geographic concentration of hash rate change

Bitcoin’s exposure to political shocks or coordinated regulation? |

|

49 |

Mining centralization |

Which technical and organizational factors most strongly

drive mining centralization despite competitive energy markets? |

|

50 |

ASIC supply chains |

How does ASIC manufacturing concentration affect

competition, security, and geopolitical leverage in Bitcoin mining? |

|

51 |

Miner balance sheets |

How do debt structures and collateral practices among

miners amplify downside risk during prolonged downturns? |

|

52 |

Renewables buildout |

Does colocating Bitcoin mining with renewables measurably

accelerate new generation buildout, or mainly improve short-run economics? |

|

53 |

Infrastructure co-location |

What efficiency gains and coordination challenges arise

when Bitcoin mining is colocated with industrial heat reuse or data centers? |

|

54 |

AI/HPC competition |

How does competition between Bitcoin mining and AI/HPC

workloads reshape data-center investment decisions? |

Answering these questions would improve policy and investment decisions by establishing credible measurement and verification standards for mining’s energy mix and emissions claims, reducing reliance on contested or inconsistent reporting. Evidence on demand response design and grid conditions would help utilities and regulators distinguish when mining supports reliability and curtailment management versus when it increases local congestion and outage risk, enabling more targeted interconnection and tariff policies. Research on methane mitigation and stranded-energy use (Bastian-Pinto et al., 2021; Dasaklis et al., 2025; Niaz et al., 2022a; Rudd et al., 2024) would clarify when mining produces net environmental benefits and when it functions primarily as a revenue overlay for fossil operations, guiding permitting and performance-based regulation. Finally, better understanding of subsidy decline, fee-market realism, and miner cost structures would sharpen assessments of Bitcoin’s long-run security budget and the economic resilience of mining firms, informing both market risk management and public narratives about network security.

Indirectly, the topics in this theme shape how jurisdictions evaluate mining as a tool of industrial development, community revenue generation, and energy-system modernization, including whether community-benefit frameworks translate mining activity into durable local gains. Findings on ASIC concentration and geographic hash rate distribution (Sun et al., 2022) would also inform debates about mining centralization and political risk, linking energy infrastructure to network resilience and governance concerns. The overlap with AI/HPC raises broader questions about how scarce grid capacity and data-center investment are allocated across competing digital industries, with implications for electricity prices, siting politics, and strategic infrastructure planning. Taken together, the results would help decision-makers distinguish between mining as a flexible industrial load that can support grid optimization and clean-energy deployment, and mining as a politically fragile activity that requires clearer evidence standards, governance safeguards, and long-run security planning.

Protocol Evolution and Technical Risk

Bitcoin’s protocol evolves through a conservative governance culture (Antonopoulos, 2015; Böhme et al., 2015) that prioritizes security and decentralization, while demand for scaling, usability, and new functionality continues to rise. The Theme 5 questions focus on how the ecosystem manages this tension, spanning soft-fork governance and legitimacy, Layer 2 solutions scaling constraints (Divakaruni and Zimmerman, 2023; Gray, 2025; Poon and Dryja, 2016), fee-market sustainability as subsidies decline, and the security risks introduced by new transaction patterns (Wang et al., 2025), interoperability designs, and privacy tooling. The theme also addresses low-probability but high-impact technical risk, most notably post-quantum transition planning (Aggarwal et al., 2018; Kearney and Perez-Delgado, 2021) and the practical failure modes that can arise during large-scale key or address-format migrations. Together, these questions treat protocol evolution as a coupled technical-and-social process, where design choices, incentives, and coordination constraints jointly determine outcomes.

Table 5. 14 imporant research questions regarding protocol evolution and technical risk.

|

No. |

Subtheme |

Question |

|

55 |

Soft-fork governance |

How can Bitcoin soft-fork governance balance timely risk

mitigation with legitimacy, minimizing community fracture? |

|

56 |

Layer 2 scaling |

Which technical, liquidity, and UX constraints most limit

scaling Bitcoin Layer 2 solutions to hundreds of millions of users? |

|

57 |

Lightning reliability |

What failure modes most threaten Lightning Network

reliability at global scale, and how can design mitigate them? |

|

58 |

Fee market sustainability |

Under plausible scenarios, are Bitcoin transaction fees

sufficient to sustain long-run security as subsidies decline? |

|

59 |

Covenants and scripting |

Do proposed covenant and scripting changes materially

improve Bitcoin functionality without increasing systemic complexity? |

|

60 |

Transaction policy risk |

How might changes to transaction standardness rules

unintentionally introduce censorship vectors or centralizing pressures? |

|

61 |

Interoperability |

Which interoperability designs preserve trust minimization

while containing systemic risk when connecting Bitcoin to external systems? |

|

62 |

Privacy tradeoffs |

How do privacy-enhancing Bitcoin tools affect adoption,

compliance pressure, and network externalities over time? |

|

63 |

Post-quantum planning |

What timelines and trigger criteria should guide Bitcoin

transition planning for post-quantum cryptography? |

|

64 |

Post-quantum efficiency |

How can post-quantum signature schemes be implemented

without prohibitive transaction size or verification costs? |

|

65 |

Key migration risk |

Which user-level failure modes pose the greatest risk

during large-scale Bitcoin key or address-format migrations? |

|

66 |

DoS and mempool risk |

Which transaction patterns or policy changes could expose

Bitcoin to denial-of-service or mempool-level attacks? |

|

67 |

Node incentives |

How do hardware, bandwidth, and operational costs shape

incentives for running fully validating Bitcoin nodes? |

|

68 |

Developer stewardship |

What funding and governance models best sustain long-term

Bitcoin protocol maintenance without compromising independence? |

Answering these questions would improve technical risk management by clarifying which governance processes can deliver timely upgrades without sacrificing legitimacy or triggering community fracture. Evidence on Layer 2 constraints and Lightning reliability (Guasoni et al., 2024; Martinazzi and Flori, 2020; Zabka et al., 2024) would help developers and operators prioritize the bottlenecks that most limit global scaling, including liquidity, UX, and routing failure modes that impede everyday use. Research on fee-market realism would sharpen assessments of long-run security incentives, informing debates about whether transaction fees can sustain security as subsidies decline and how policy and usage patterns affect that trajectory. Finally, clearer understanding of interoperability boundaries, privacy tradeoffs, and denial-of-service risks would support the design of guardrails that preserve trust minimization while limiting systemic risk from bridges, new transaction patterns, or policy changes.

This theme informs how policy-makers, institutions, and users interpret Bitcoin’s capacity to scale without compromising core security guarantees, which affects adoption pathways and regulatory expectations. Findings on post-quantum planning and migration failure modes would also shape contingency strategies for custodians, exchanges, and large holders, reducing the risk that technical transitions become disorderly social events with market-wide consequences. Evidence on developer funding and stewardship models would clarify how Bitcoin maintains long-run maintenance capacity without drifting toward centralized control, an issue that parallels governance challenges in other critical digital infrastructures. The results would help stakeholders distinguish between productive innovation that expands Bitcoin’s utility and changes that increase complexity, introduce hidden trust assumptions, or raise coordination costs beyond what the ecosystem can reliably manage.

Custody, Security, and Financial Intermediation

Custody and intermediation determine whether Bitcoin’s promise of user sovereignty translates into durable real-world security for households, firms, and institutions. The Theme 6 questions focus on the main failure modes that drive losses and systemic shocks – usability-driven self-custody errors, social engineering, hardware wallet supply-chain compromise, multisignature coordination failures, and inheritance breakdowns that strand wealth across generations (Eleshin et al., 2025; Garcia-Teruel and Simón-Moreno, 2021). The theme also addresses institutional custody controls, proof-of-reserves and liability disclosure, insurance feasibility, and the expansion of Bitcoin-backed credit, areas where opaque practices can recreate familiar leverage and run dynamics from traditional finance. Taken together, these questions treat custody as a socio-technical system in which human factors, operational processes, and intermediation incentives jointly shape security outcomes.

Table 6. 12 imporant research questions regarding custody, security, and financial intermediation.

|

No. |

Subtheme |

Question |

|

70 |

Self-custody usability |

Which Bitcoin wallet defaults and recovery workflows most

reduce irreversible errors while preserving self-custody? |

|

71 |

Multisignature recovery |

What multisignature coordination models minimize

operational failure and loss during recovery or emergency access? |

|

72 |

Hardware wallet risk |

How vulnerable are hardware wallets to supply-chain

compromise, and which verification practices reduce that risk? |

|

73 |

Social engineering |

Which social-engineering attack vectors account for the

largest Bitcoin losses, and how can design mitigate them? |

|

74 |

Inheritance |

Which inheritance mechanisms enable secure Bitcoin

transfer across generations while minimizing custodial reliance? |

|

75 |

Time locks and vaults |

How reliable are time-locked and vault-based custody

schemes under real-world threat models? |

|

76 |

Institutional custody controls |

What custody control frameworks best prevent misuse or

commingling of client Bitcoin at institutional custodians? |

|

77 |

Proof-of-reserves |

Which Bitcoin proof-of-reserves and liability disclosure

standards deter fractional-reserve behavior while protecting privacy? |

|

78 |

Custody insurance |

How can Bitcoin custody insurance be priced and verified

without invasive surveillance? |

|

79 |

Professional cosigners |

Under what conditions do professional cosigners reduce

custody risk rather than introduce new failure points? |

|

80 |

Exchange run risk |

Which indicators most reliably predict Bitcoin exchange

insolvency or run risk? |

|

81 |

Bitcoin-backed credit |

How can Bitcoin-backed credit expand while limiting opaque

leverage and forced-liquidation feedback loops? |

Answering these questions would materially reduce loss risk by identifying which wallet defaults, recovery workflows, and multisignature coordination models most effectively prevent irreversible errors and operational failures. Evidence on dominant social-engineering vectors and supply-chain vulnerabilities would help designers and auditors prioritize mitigations that work at scale, especially for non-expert users. Research on inheritance mechanisms would improve intergenerational continuity by clarifying how Bitcoin can transfer securely without forcing families into custodial dependence or brittle legal workarounds. On the institutional side, clearer standards for custody controls and proof-of-reserves would strengthen market integrity by deterring commingling and fractional-reserve behavior, while evidence on insurance and credit design would inform how Bitcoin-backed lending can grow without introducing opaque leverage and forced-liquidation feedback loops.

This theme indirectly shapes adoption trajectories because perceived custody risk remains a binding constraint for many potential users and a central justification for regulatory pressure toward intermediated solutions. Stronger evidence on what actually reduces risk – rather than what merely shifts risk – would clarify when self-custody can be made safer through design and education, and when institutional custody adds resilience versus concentrated failure points. Findings on exchange run indicators, insurance feasibility, and credit practices would also inform how systemic shocks propagate through intermediation layers, improving early-warning capabilities for policy-makers and market participants. Collectively, the results would help stakeholders distinguish between custody ecosystems that reinforce Bitcoin’s core sovereignty properties and custody ecosystems that reintroduce fragility through opaque intermediaries, weak controls, or poorly understood human-factor risks.

Regulation, Law, and Governance

Regulation, law, and governance shape how Bitcoin integrates into existing financial and legal systems, and whether that integration preserves its core properties or channels activity toward centralized intermediaries. The Theme 7 questions focus on legal classification, market-structure authority, custody arrangements, anti-money laundering and ‘know your customer’ (AML/KYC) regulatory design, tax treatment, and liability standards, areas where ambiguity or misalignment can create durable distortions in behavior and risk allocation (Butler, 2019; Dabbous et al., 2022; Möser et al., 2013; Turner et al., 2020). The theme treats regulation as an institutional design problem rather than a binary choice between permissiveness and restriction, emphasizing how legal definitions, enforcement reach, and policy durability influence incentives for users, firms, and governments. It also reflects the reality that Bitcoin regulation increasingly operates across jurisdictions, where fragmented approaches can undermine stated policy goals while accelerating regulatory arbitrage.

Table 7. 12 imporant research questions regarding regulation, law, and governance.

|

No. |

Subtheme |

Question |

|

82 |

Market structure law |

How can market-structure legislation delineate authority

over Bitcoin while minimizing overlapping mandates? |

|

83 |

Legal classification |

What legal criteria most effectively distinguish Bitcoin

from tokenized digital assets? |

|

84 |

Custody regulation |

Which Bitcoin custody standards protect consumers without

incentivizing centralization? |

|

85 |

Debanking |

What legal protections can prevent coordinated debanking

of Bitcoin-related firms? |

|

86 |

AML/KYC balance |

How can AML/KYC regimes target illicit finance while

preserving lawful non-custodial Bitcoin use? |

|

87 |

Privacy vs surveillance |

Where should legal boundaries be drawn between financial

privacy and state surveillance in Bitcoin transactions? |

|

Tax policy |

How do current

Bitcoin tax rules distort behavior, and which reforms improve compliance with

minimal friction? |

|

|

Mining regulation |

Which Bitcoin

mining regulatory approaches best balance environmental, grid, and

development goals? |

|

|

Cross-border

enforcement |

What practical

limits does Bitcoin impose on cross-border financial enforcement? |

|

|

Multisig and

fiduciary law |

How should

multisignature Bitcoin arrangements be treated under fiduciary and trust law? |

|

|

Software

liability |

What liability

frameworks assign responsibility for Bitcoin software failures without

chilling open-source development? |

|

|

Regulatory

durability |

Which legal

mechanisms increase durability of Bitcoin regulation across political

turnover? |

Addressing these questions would improve regulatory clarity by delineating authority across agencies, reducing overlapping mandates, and clarifying how Bitcoin differs from tokenized digital assets under securities and commodities law. Evidence on custody standards, debanking protections, and multisignature legal treatment would help lawmakers design consumer protections that do not inadvertently force users into centralized intermediaries or restrict lawful self-custody. Research on AML/KYC balance and tax policy would inform compliance regimes that target illicit activity and improve reporting accuracy without imposing disproportionate burdens that distort everyday use. Clearer liability frameworks for Bitcoin software and service providers would also shape innovation incentives by defining responsibility boundaries without chilling open-source development or responsible disclosure.

This theme indirectly affects the durability and legitimacy of Bitcoin policy over time, particularly as political leadership changes and regulatory priorities shift. Findings on cross-border enforcement limits and international coordination would help policy-makers identify where harmonization adds value and where national discretion is both unavoidable and appropriate. Evidence on regulatory stability would also inform how firms and users plan long-term investments, custody arrangements, and operational footprints under legal uncertainty. Collectively, the results would support a transition from reactive, enforcement-driven approaches toward governance frameworks that are predictable, proportionate, and resilient, reducing the likelihood that Bitcoin regulation amplifies financial fragility, undermines trust, or locks in unintended centralization.

Social, Cultural, and Behavioral Change

Bitcoin adoption unfolds through social learning, narrative competition, and behavior change as much as through technology and price (Balutel et al., 2022; Collins and Rudd, 2025; Mustafa et al., 2024; Nadeem et al., 2021; Rejeb et al., 2023; Walker, 2024). The Theme 8 questions focus on how people acquire Bitcoin literacy outside formal institutions, how misinformation and simplified narratives shape public understanding, and whether long-term saving in Bitcoin changes time preference and household debt behavior. The theme also examines the conditions under which local circular economies (Apatu and Goudar, 2024) persist beyond early adopters, how declining trust in public institutions influences adoption motives, and whether Bitcoin reduces remittance costs and improves reliability for underbanked users in practice. Finally, it addresses two practical constraints on sustained adoption: personal safety and coercion risk in custody decisions, and internal polarization within the Bitcoin community that can undermine coordination on upgrades and public communication.

Table 8. Seven imporant research questions regarding social, cultural, and behavioral change.

|

No. |

Subtheme |

Question |

|

Financial

literacy |

Which

non-institutional channels most effectively improve Bitcoin literacy and risk

awareness? |

|

|

Misinformation |

How do

misinformation and simplified narratives shape public understanding of

Bitcoin over time? |

|

|

Time preference |

Does long-term

Bitcoin saving measurably change time preference and household debt outcomes? |

|

|

Circular

economies |

Which local

conditions enable Bitcoin circular economies to persist beyond early

adopters? |

|

|

Trust and

legitimacy |

To what extent is

Bitcoin adoption driven by declining institutional trust versus pragmatic

finance? |

|

|

Financial

inclusion |

How effectively

does Bitcoin reduce remittance costs and improve reliability for underbanked

users? |

|

|

Personal safety |

How do concerns

about coercion and personal safety influence Bitcoin custody practices? |

Research that addresses these questions would improve the effectiveness of education and risk communication by identifying which non-institutional channels most reliably raise Bitcoin literacy and reduce preventable errors. Evidence on misinformation dynamics would support more credible public discourse and help educators and policy-makers distinguish persistent myths from legitimate concerns that require policy response. Research on time preference and debt outcomes would clarify whether Bitcoin saving produces measurable household-level behavioral change, moving beyond anecdote to testable claims. Better understanding of circular economy persistence, remittance outcomes, and underbanked reliability would also sharpen the evidence base for inclusion-oriented initiatives, including where frictions such as cash-in/out, volatility, and local infrastructure constrain real-world benefits.

Indirectly, this theme informs how societies interpret Bitcoin’s role during legitimacy crises, including whether adoption is primarily a protest signal, a pragmatic hedge, or both, and how those motives affect long-run behavior. Findings on personal safety and coercion risk would influence custody norms and tool design, shaping whether self-custody becomes more accessible or remains a perceived high-risk practice for many households. Evidence on internal polarization and coordination failure would also matter for Bitcoin’s long-run governance capacity, since social fragmentation can slow technical progress and degrade external communication. The collective results would clarify whether Bitcoin’s growth is best understood as a durable cultural and behavioral shift, a set of localized adoption experiments with uneven outcomes, or a cyclical phenomenon that depends on narratives and trust as much as on technology and markets.

Discussion

Shifts in Perceived Research Priorities in 2025

Relative to earlier Bitcoin horizon scans and key question exercises (Rudd, 2024, 2023b, 2025a, c; Rudd et al., 2023), the 2025 results indicate a noticeable shift in perceived research priorities away from first-order questions about Bitcoin’s legitimacy, adoption potential, or basic economic properties, and toward higher-order questions about implementation, fragility, and institutional interaction. In prior years, a large share of discourse focused on whether Bitcoin could function as a hedge, a payment rail, or a store of value under various macroeconomic conditions. In contrast, the 2025 questions increasingly assume Bitcoin’s continued relevance and instead interrogate how its growing integration interacts with monetary policy constraints, market microstructure, custody practices, and regulatory design.

One prominent change is the migration of macroeconomic questions from abstract debates toward operational thresholds and regime dynamics. Earlier scans emphasized broad narratives around inflation protection and monetary debasement, whereas the 2025 questions concentrate on identifying indicators of regime transition, the limits imposed by fiscal dominance, and the conditions under which Bitcoin shifts from hedging instrument to volatility amplifier. This reframing reflects a maturation of the discourse, where participants increasingly seek tools for diagnosis and stress testing rather than validation of Bitcoin’s macro relevance.

A second shift concerns institutional and market-structure priorities. Compared to 2023 and 2024, substantially more attention is directed toward hidden leverage, custody integrity, margining standards, and liquidation dynamics. Rather than treating institutional adoption as an unambiguous stabilizing force, the 2025 questions highlight the possibility that balance-sheet reflexivity, concentration of intermediaries, and opaque credit structures may reintroduce systemic vulnerabilities familiar from traditional finance. This represents a move from adoption optimism toward scrutiny of financial plumbing and failure modes (Rudd, 2025b).

Energy and mining discussions also show a change in emphasis. Earlier scans devoted considerable attention to whether Bitcoin mining could align with decarbonization goals or renewable integration (Rudd, 2023a; Rudd et al., 2023). In 2025, the questions focus more narrowly on measurement credibility, regulatory conditions under which net benefits arise, and the political and economic limits of community acceptance. The emergence of competition between Bitcoin mining and AI/HPC workloads for power and data-center infrastructure further shifts attention toward allocation tradeoffs and strategic infrastructure planning, a topic that was largely absent in earlier scans.

Finally, social and governance-oriented priorities exhibit greater realism about constraints. Questions about education, financial inclusion, and circular economies persist, but they are increasingly framed around persistence, failure modes, and unintended consequences rather than aspirational outcomes. Similarly, governance and regulatory questions emphasize durability, enforcement limits, and jurisdictional fragmentation rather than idealized regulatory solutions. These shifts suggest that the 2025 discourse treats Bitcoin less as a speculative disruption and more as a persistent system whose risks, interactions, and indirect effects now warrant closer empirical and institutional scrutiny.

Persistent Core Uncertainties

Despite shifts in emphasis toward implementation and fragility, several core uncertainties remain unresolved across successive horizon scans. These uncertainties persist not because they are poorly articulated but because they sit at the intersection of technical constraints, institutional incentives, and political economy in ways that resist straightforward empirical resolution. The 2025 questions continue to emphasize these issues repeatedly, suggesting that they represent structural blind spots rather than transient research gaps.

One enduring uncertainty concerns Bitcoin’s macroeconomic role across regimes. While discourse has moved beyond simple claims that Bitcoin hedges inflation, there remains limited agreement on how Bitcoin behaves across different combinations of inflation, deflation, liquidity stress, and fiscal dominance. Questions about regime identification, timing, and signal reliability recur because they depend on counterfactuals that cannot be observed directly and on indicators that are often revised, politicized, or only visible after stress events unfold. As a result, both policy-makers and market participants continue to operate with incomplete models of how Bitcoin interacts with broader monetary dynamics.

A second persistent uncertainty involves security and decentralization tradeoffs under scale. At the protocol level, questions about fee-market sufficiency, Layer 2 reliability, privacy tooling, and long-term maintenance recur because they hinge on adoption patterns that have not yet stabilized. At the market level, similar uncertainty appears in debates about custody concentration, leverage, and intermediation. In both cases, outcomes depend less on technical feasibility than on coordination, incentives, and user behavior, which evolve unevenly and are difficult to forecast. This makes it challenging to distinguish temporary growing pains from durable structural risks.

Governance and regulation present a third category of unresolved uncertainty. Repeated attention to legal classification, enforcement limits, AML/KYC balance, and regulatory durability reflects the absence of stable institutional equilibria. Jurisdictional fragmentation, political turnover, and the cross-border nature of Bitcoin activity mean that regulatory outcomes are path-dependent and often reactive. Even when technical solutions or policy designs are well understood in principle, their real-world effectiveness depends on enforcement capacity, legitimacy, and international coordination, all of which vary widely.

Finally, social and behavioral uncertainties remain central. Questions about education effectiveness, misinformation, trust erosion, and long-term behavior change (Ammous and D'Andrea, 2022) persist because they involve slow-moving cultural dynamics rather than discrete interventions. Evidence from prior years suggests that technical improvements alone do not resolve these issues, yet scalable alternatives to informal learning and narrative-driven adoption remain limited. The continued prominence of these questions in 2025 underscores that Bitcoin’s evolution is constrained as much by human factors and institutional adaptation as by code or market structure.

Together, these persistent uncertainties highlight the limits of treating Bitcoin research as a sequence of solvable technical problems. Instead, they point to the need for longitudinal, crossdisciplinary research that can track how technical systems, institutions, and behavior co-evolve over time (Rudd, 2023d), and how unresolved uncertainties shape both policy responses and market outcomes.

Cross-Cutting Interactions and Compound Risks

Although the 2025 scan organizes research priorities into discrete themes, several interactions cut across these categories in ways that materially affect risk, governance, and interpretation. These cross-cutting dynamics do not simply connect topics; they create compound effects where vulnerabilities in one domain amplify outcomes in another. As such, they warrant explicit attention despite efforts to keep thematic overlap limited.

One prominent interaction links macroeconomic stress, custody practices, and regulation. Questions in Theme 1 emphasize confidence shocks, banking stress, and liquidity-driven regime shifts, while Themes 6 and 7 focus on custody design and legal frameworks. Together, they highlight a compound risk: during periods of macro stress, households and firms may attempt rapid shifts into Bitcoin precisely when custody systems, exchanges, and regulatory guardrails are least resilient. This interaction suggests that custody failures, exchange runs, or abrupt regulatory interventions are not independent risks but are more likely to cluster during macroeconomic stress events, magnifying losses and undermining trust.

A second cross-cutting interaction connects institutional adoption, market structure, and protocol constraints. Theme 3 questions point to hidden leverage, margining practices, and concentration among intermediaries, while Theme 5 raises concerns about fee-market sustainability, scaling limits, and governance legitimacy. These questions collectively imply that institutional integration can outpace protocol and governance capacity, creating situations where financial exposure grows faster than the system’s ability to absorb shocks or coordinate upgrades. This interaction reframes institutional adoption not as a stabilizing force per se, but as a potential source of systemic pressure if market plumbing evolves without corresponding advances in protocol robustness and governance processes.

A third interaction links energy policy, mining geography, and geopolitics. Theme 4 focuses on grid impacts, emissions measurement, and stranded-energy monetization, while Theme 2 addresses state strategy, sovereignty, and resource politics. Combined, they indicate that mining decisions increasingly sit at the intersection of local energy governance and national strategic interests. This creates feedback loops in which energy policy choices influence network security and geographic concentration, which in turn shape political risk and regulatory responses. In this context, mining outcomes cannot be evaluated solely on environmental or economic grounds; they must also be assessed in light of geopolitical incentives and state capacity.

These cross-cutting interactions (see Rudd, 2025a for a deep dive on interactions from the 2024 scan) underscore that many of the highest-impact risks and opportunities identified in the 2025 scan emerge not within individual themes but at their intersections. Recognizing these compound dynamics helps explain why certain uncertainties persist across years and why narrowly scoped interventions – technical, regulatory, or market-based – often fail to deliver expected stability. For researchers and policy-makers, the implication is that effective responses will require coordinated attention to how macro conditions, institutional behavior, technical constraints, and governance frameworks interact under stress, rather than isolated solutions within any single domain.

Higher-Order Impacts Inferred from Practitioner Discourse

Beyond the first-order outputs that would be delivered when addressing research questions identified in this scan, the practitioner discourse reveals a consistent concern with indirect and higher-order effects that arise as Bitcoin becomes more deeply embedded in financial, institutional, and infrastructural systems. These second- and third-order impacts are rarely articulated as discrete research questions in isolation, yet they recur implicitly across discussions of macro stress, custody, regulation, mining, and governance. Several recurring pathways exist through which initial changes propagate into wider system effects.

A central second-order effect involves feedback loops between institutional adoption and fragility. Practitioners frequently note that while institutional participation can deepen liquidity and legitimacy, it can also introduce balance-sheet reflexivity, leverage, and correlated behavior that amplify shocks (also see Rudd, 2025b). For example, Bitcoin-backed credit, exchange-traded products, and corporate treasury strategies may appear stable under normal conditions but interact in nonlinear ways during liquidity stress, leading to rapid deleveraging, custody bottlenecks, or forced policy responses. These dynamics suggest that institutionalization changes not only who holds Bitcoin, but how risk propagates through the system.

Another recurring pathway concerns regulatory response and behavioral adaptation. Practitioner discussions often emphasize that regulatory interventions – particularly during crises – can generate unintended consequences by altering incentives rather than eliminating underlying risks. Restrictions on custody, access, or intermediation may push users toward less transparent channels, increase concentration among a smaller number of compliant intermediaries, or accelerate cross-border relocation of capital and expertise. Over time, such responses can reshape market structure and governance in ways that differ substantially from their original intent, creating third-order effects that only become visible after several policy cycles.

Energy and infrastructure debates surface a different class of indirect effects. Discussions about mining frequently extend beyond emissions or grid impacts to questions of political legitimacy, community acceptance, and strategic infrastructure control. Practitioner narratives suggest that mining projects can alter local power dynamics by tying municipal revenues, grid planning, or industrial development strategies to volatile global markets. At a higher order, the growing competition between Bitcoin mining and AI/HPC workloads for power and data-center capacity may influence national infrastructure priorities, electricity pricing, and industrial policy in ways that are not yet captured in conventional energy or technology assessments.

Finally, social and governance-related discourse highlights longer-term cultural feedbacks. Education efforts, misinformation, and internal polarization are often discussed not as isolated problems but as reinforcing dynamics that affect coordination, trust, and adaptability. Practitioner commentary suggests that failure to resolve basic usability, custody, or governance challenges can erode legitimacy over time, making technical solutions harder to deploy and regulatory engagement more adversarial. These third-order effects operate on longer time horizons, but they shape whether Bitcoin evolves as a resilient socio-technical system or fragments into incompatible institutional and cultural pathways.

Taken together, these inferred second- and third-order impacts illustrate why many of the most consequential risks and opportunities associated with Bitcoin are unlikely to be captured by single-discipline analyses or first-order metrics. They point to the need for research that explicitly traces feedback loops, path dependence, and institutional adaptation over time, rather than treating observed outcomes as isolated events. By highlighting these higher-order dynamics, the 2025 scan provides a foundation for future work that moves beyond identifying information gaps toward understanding how those gaps interact to shape long-run system behavior.

Implications for Future Research Agendas

The 2025 key questions point to a research agenda that differs in important ways from much of the existing academic literature on Bitcoin. Rather than focusing primarily on price prediction, adoption correlations, or stylized efficiency tests, the priorities identified here emphasize institutional fragility, governance under stress, and the interaction between technical systems and political constraints. This shift reflects a growing recognition within practitioner discourse that many of Bitcoin’s most consequential effects arise not from its basic design features, but from how those features interact with legacy financial systems, regulatory frameworks, and human behavior at scale.

One implication is the need for more crossdisciplinary research designs that combine economic modeling, legal analysis, systems engineering, and behavioral science; transdisciplinary research that engages policy-makers and practitioners would be particularly well-suited for creating policy-salient evidence built on real-world understanding of Bitcoin production and use (Rudd, 2023d).

Questions about custody risk, liquidation cascades, regulatory durability, and infrastructure competition cannot be answered credibly within a single disciplinary silo. Addressing them will require mixed methods (Creswell and Poth, 2016), including institutional case studies, stress-testing exercises, natural experiments during periods of market stress, and comparative analyses across jurisdictions. Importantly, many of these questions are time-dependent, suggesting value in longitudinal approaches that track how behavior and institutional responses evolve rather than relying on cross-sectional snapshots.

A second implication concerns the alignment between academic incentives and policy-relevant research needs. Many of the questions identified in this scan are difficult to operationalize using readily available datasets and do not map cleanly onto standard econometric templates. As a result, they may remain underexplored despite their practical importance. Explicitly recognizing these gaps can help funding agencies, research institutions, and independent scholars justify investments in data collection, qualitative fieldwork, and collaborative research with practitioners, even when such work produces fewer conventional academic outputs.

Finally, the structure of the 2025 scan itself suggests a role for iterative horizon scanning as a complement to traditional research agendas. Several questions recur across years with shifting emphasis, indicating that progress is uneven and often contingent on external shocks, regulatory changes, or technological milestones. Rather than treating the resulting list as a static research agenda, it may be more productive to view it as a living framework that can be revisited as conditions change. In that sense, the primary contribution of this exercise is not only the identification of specific questions, but the demonstration of a scalable approach for tracking how perceived research needs evolve as Bitcoin transitions from a disruptive innovation into a persistent component of the global financial and technological landscape.

Conclusions

This horizon scan identifies 100 policy-salient research questions that reflect how Bitcoin is increasingly understood by practitioners: not as a speculative novelty, but as a persistent, complex adaptive system interacting with macroeconomic stress, institutional fragility, infrastructure constraints, and governance limits. By drawing on long-form discourse rather than formal solicitations, the scan surfaces information gaps that tend to emerge before they are formalized in academic or policy research. The resulting questions span monetary dynamics, geopolitics, market structure, mining and energy systems, protocol risk, custody and intermediation, regulation, and social behavior, offering a structured map of perceived uncertainties at a moment of deeper institutional integration.

Several themes stand out across the analysis. First, priorities have shifted away from first-order debates about legitimacy or adoption toward second-order concerns about implementation, fragility, and feedback effects. Second, many of the most consequential risks and opportunities arise at the intersections between domains – where macro stress meets custody design, where institutional leverage meets protocol constraints, or where energy policy meets geopolitics – rather than within any single technical or disciplinary silo. Third, practitioner discourse increasingly emphasizes indirect and higher-order impacts, including regulatory adaptation, infrastructure competition, and behavioral responses under stress, underscoring the limits of narrowly scoped analyses.

The contribution of this paper is therefore neither predictive or prescriptive, but diagnostic in nature. This encourages pragmatist thinking about Bitcoin (Rudd, 2023c), identifying, addressing, and adapting to surprising new threats and opportunities as they arise (Bromley, 2006). It provides a snapshot of where informed participants perceive the most important unanswered questions to lie as Bitcoin becomes embedded in existing economic and institutional systems.

For researchers, the scan highlights areas where current academic coverage appears misaligned with emerging decision needs. For policy-makers and practitioners, it offers a structured way to engage uncertainty without relying on narratives or isolated indicators. More broadly, the exercise demonstrates the value of iterative horizon scanning for technologies whose impacts unfold through interaction with legacy institutions, suggesting that continued, adaptive mapping of research priorities will remain necessary as Bitcoin’s role evolves.

References

Adrian, Tobias and Hyun Song Shin. 2010. Liquidity and leverage. Journal of Financial Intermediation 19: 418-437. https://doi.org/10.1016/j.jfi.2008.12.002

Aggarwal, Divesh, Gavin Brennen, Troy Lee, Miklos Santha and Marco Tomamichel. 2018. Quantum attacks on Bitcoin, and how to protect against them. Ledger 3: 127. https://doi.org/10.5195/ledger.2018.127

Aizenman, Joshua and Nancy Marion. 2011. Using inflation to erode the US public debt. Journal of Macroeconomics 33: 524-541. https://doi.org/10.1016/j.jmacro.2011.09.001

Akhtaruzzaman, Md, Ahmet Sensoy and Shaen Corbet. 2020. The influence of Bitcoin on portfolio diversification and design. Finance Research Letters 37: 101344. https://doi.org/10.1016/j.frl.2019.101344

Al Kez, Dlzar, Aoife M. Foley, David Laverty, Dylan Furszyfer Del Rio and Benjamin Sovacool. 2022. Exploring the sustainability challenges facing digitalization and internet data centers. Journal of Cleaner Production 371: 133633. https://doi.org/10.1016/j.jclepro.2022.133633

Alexakis, Christos, Giulio Anselmi and Giovanni Petrella. 2024. Flight to cryptos: evidence on the use of cryptocurrencies in times of geopolitical tensions. International Review of Economics & Finance 89: 498-523. https://doi.org/10.1016/j.iref.2023.07.054

Ammous, Saifedean and Fernando Antonio Monteiro Christoph D'Andrea. 2022. Hard money and time preference: a Bitcoin perspective. MISES: Interdisciplinary Journal of Philosophy, Law and Economics 10: https://doi.org/10.30800/mises.32022.v30810.31495

Ang, Andrew, Tom Morris and Raffaele Savi. 2022. Asset allocation with crypto: application of preferences for positive skewness. The Journal of Alternative Investments 25: 7-28. https://doi.org/10.3905/jai.2023.1.185

Antonopoulos, Andreas M. 2015. Mastering Bitcoin: Unlocking Digital Cryptocurrencies. Sebastol, CA: O'Reilly Media, Inc.

Apatu, Emma and Poornima Goudar. 2024. Bitcoin use cases: a scoping review. Challenges 15. https://doi.org/10.3390/challe15010015