Bitcoin supply, demand, and price dynamics

We develop a bottom-up, quantity-clearing model of Bitcoin price formation that couples its fixed 21-million-coin cap with plausible demand growth and execution behavior.

Here is the SSRN link for a new working paper now out: https://dx.doi.org/10.2139/ssrn.5386623

This is a followup paper on our first modeling paper: https://doi.org/10.3390/jrfm18020066

For a quick rundown on the content, see my thread on X: https://x.com/DrMurrayRudd/status/1955312083932942417

I will be posting various example scenarios and further content over the next while - follow me on X to get messages of when these come out.

Here is part of the abstract for the paper:

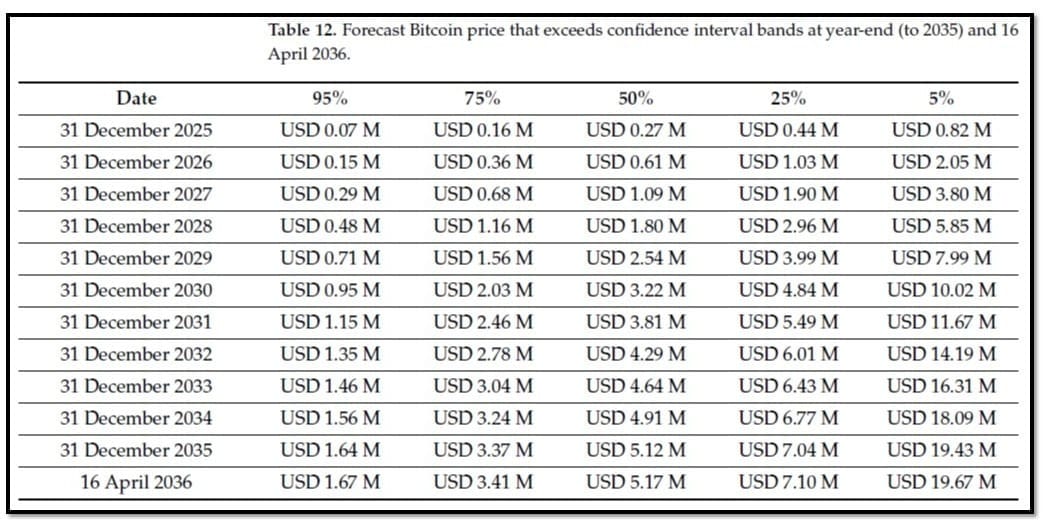

...A Monte Carlo simulation that randomly sampled across all five key variables found a 75% likelihood that Bitcoin price will exceed US $4.81 million by April 2036. Generally, prices from the low single-millions to the low tens-of-millions per coin by 2036 emerge under broad parameter sets; hyperbolic paths to higher price levels are relatively rare and concentrate when liquid supply falls near or below 2 million Bitcoin and withdrawal sensitivity is low...

Comments ()